Anya Showcase

Have a Peek

Booming Philippine Tourism

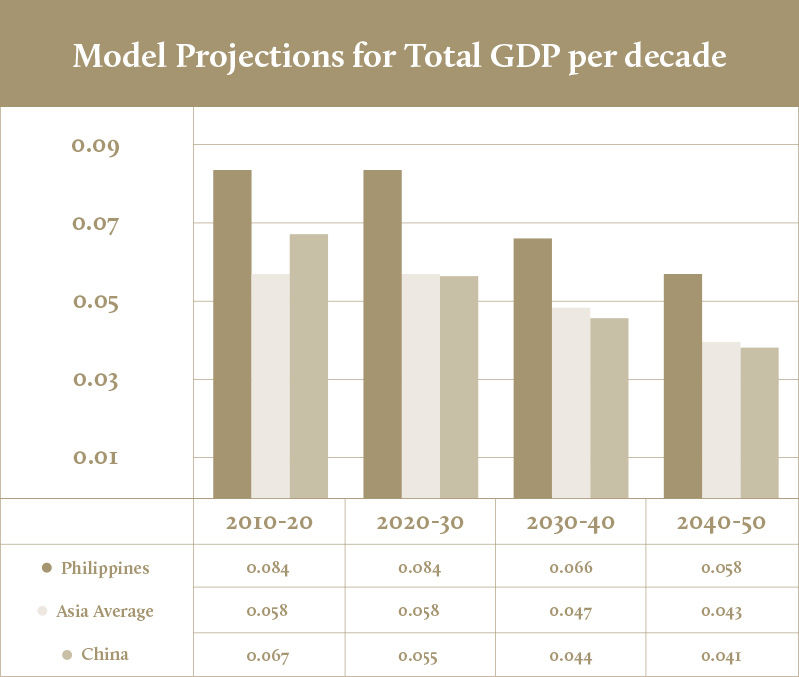

The Philippines is forecasted to lead the Asian economies over the next four decades, and by the year 2050 to have positioned itself as the 16th largest economy in the world having risen an astonishing 27 places in the global rankings.

The demand in the hotel and leisure sector is already at an unprecedented level and exceeding existing supply as can be seen through its unusually high occupancy rates. The demand curve, at least over the coming decade demonstrates a widening gap as hotel supply and more significantly, luxury hotel supply falls behind demand.

The world is working harder than ever before and especially in the Philippines; giving them less time to vacation, despite rapid increases in disposable income. This combined higher liquidity coupled with limited time availability for vacations is leading to the tremendous growth in highly accessible weekend retreats.

Room rates as well as occupancy rates are increasing; while there is a great demand for international quality in hotels and resorts in highly accessible locations. Tagaytay just being 70 minutes away from the wealth capital of the Philippines, Manila is ideally located to capitalize on this opportunity.

Why Tagaytay?

Home to cool and crisp climate and calm sceneries, Tagaytay is a stone’s throw away from Metro Manila, a choice retreat and getaway for modern day city dwellers. Through the years, it has grown to become a bright spot for real estate in the Philippines, dotted with restaurants, spas, and wellness centers, as well as resort residences, homes, and houses. Boasting of unhampered development in recent decades, Tagaytay has become host to working and growing investments in the Philippines.

While destinations like Boracay and Mactan in Cebu offer attractive prospects in real estate development, Tagaytay’s 70-minute drive proximity and accessibility to the prime business and commercial centers of the country gives it a key edge in the realm of real estate investment.

Meeting the Demand for Luxury

The Philippines is growing, and this is no more evident in its peoples’ affluence and reduced vacation times. Seeking luxurious weekend getaways, Filipinos demand quality when it comes to service, dining, design, and the overall experience. Anya Resort and Residences exceeds those expectations.

“Filipinos demand quality when it comes to service, dining, design, and the overall experience. Anya exceeds those expectations.”

With the ever-increasing demand for luxurious, activity/amenity-rich, and accessible retreats, the Anya Investment opportunity is designed and financially structured to appeal to the most experienced investors.

Around the world, the first resorts to succeed in emerging cities are those close to the wealthiest communities, whose hardworking denizens require easy getaways after a hard week’s work. Tagaytay, just over an hour away from Manila, is one of the country’s favorite destinations, thanks to its temperate climate and natural features.

However, there is no high-quality luxury resort provide overnight accommodation in Tagaytay.

“Anya not only fulfils this emerging demand, but is also positioned to be one of the top five luxury resorts in the Philippines.”

Anya provides designs found only in the most luxurious resorts around the world, and an extensive range of dining, wellness, relaxation and entertainment amenities accompanied by personal and world- class service. The upscale guest will not find anything better near Manila.

This design, combined with a highly effective domestic, regional, and international marketing strategy and partnership, leads your investment to class- and country- leading returns.

For those early investors we see net returns of over 10%, which combined with a simple and risk-free exit strategy compounds for unprecedented returns and the best use of cash.

Response to Market Forces

According to STR data, 458 hotels and 123,325 rooms are now being built around the world. 253 of the hotels are in the Asia-Pacific region, the area with the largest predicted growth in billions. The next wave of luxury hotels around the world is expected to meet the standards of the top Asian resorts with exceptional service, privacy, and landscapes. The rapid development of the luxury market in Asia is sending ripples through the entire industry and will continue to set trends.

“The rapid development of the luxury market in Asia will set the trend in the entire industry.”

The Luxury Sector in the Philippines

From 2004 to 2011, there was a 3.2% growth in luxury hotel supply, which is less than one-third of the international average. Room rates rose by 6% and occupancy averaged 72%, rising above the international average. This is evidence of demand overtaking supply. The Philippines needs luxury hotels for a rapidly expanding high net wealth individual sector, overseas business, and tourist demand.

Luxury Sector Potential

The Philippines is emerging as not only an economic force, but also as a top tourist destination. The luxury hotel sector is performing at above average levels because the supply is well below the demand. Below are the only international standard luxury hotels in the country and their respective performances. Any other major tourist destination around the world has many more rooms.

Your Return on Investment

Anya is a securitized and flexible asset. Our association with some of the leading brands, distribution channels, and marketing experts ensures that room revenues are at their peak. Current projections in the country for this type of investment point towards a consistent 8% cash yield per year on the purchased asset price. Considering a 20% equity investment, payback periods are seen over the first four years, care of a combined cash yield and realistic capital appreciation return.

Maximum Return, Minimal Usage

As a secured investor in the project with an attached CCT, there are flexible revenue sharing options, dependent upon the return versus your usage requirements. Typically, most investors seek a four-week usage, while some require up to three months. It all depends on the returns you seek. The less you use, the more you earn. Ultimately, you control your profits, while Anya optimizes your earnings.

The Rental Program

Anya is designed to cater to a range of owners and investors. For owners looking to rent their home to sufficiently cover their monthly costs, we offer a flexible program designed to rent the home over a few nights per year to cover your ownership costs. For owners looking for usage over a total of 2-3 months per year, outside of which they are looking to earn a good return: we primarily offer investment units with good income and profit levels, paid out on a quarterly basis. Investors seeking minimal usage but class-leading cash returns should invest in our core inventory and can expect to see unrivalled profits, payable on a quarterly basis.